Economic globalization equates to economic servitude

In a world where economic control and loss of individual sovereignty loom large, one man finds himself entangled in the complex web of globalism and central bank digital currencies (CBDCs).

Living alone in a tiny apartment, the man's life has been significantly impacted by the implementation of CBDCs. His digital account receives central bank digital currency units monthly, but he is constantly monitored, his every transaction tracked in real time. The fear of having his assets frozen or seized without due process hangs over him.

The man's income is not determined by his hard work alone. It is influenced by the number of hours he works, the government's valuation of his work, taxes, and redistribution of income to other citizens. His savings, once a source of security, have vanished within 90 days. His social credit score decreases if he does something the government deems contrary to his well-being, resulting in a fraction of his discretionary income being deducted.

In the article "Globalism is Economic Slavery" by J.B. Shurk on The Burning Platform, this scenario is painted as a dystopian future where globalism, empowered by CBDCs, erodes economic freedom and individual rights, turning people into subjects of a digital economic system designed to enslave rather than liberate.

The man's situation is a stark reminder of the potential consequences of CBDCs. They facilitate unprecedented surveillance and control, enabling governments to enforce strict spending limits or restrictions, and to instantly freeze or seize assets without due process. The elimination of cash removes anonymity from financial exchanges, further eroding privacy and autonomy.

The man's plight is not unique. The current system, with its manipulation of money by central banks and fiat currencies, benefits the wealthy while everyone else tries to balance life precariously on a tightrope. Easy money sustains companies that produce no market value, making bad companies lucrative investment opportunities in fake markets. Gross inequality and rampant poverty do not matter if governments can convince unhappy citizens to own less and sacrifice more.

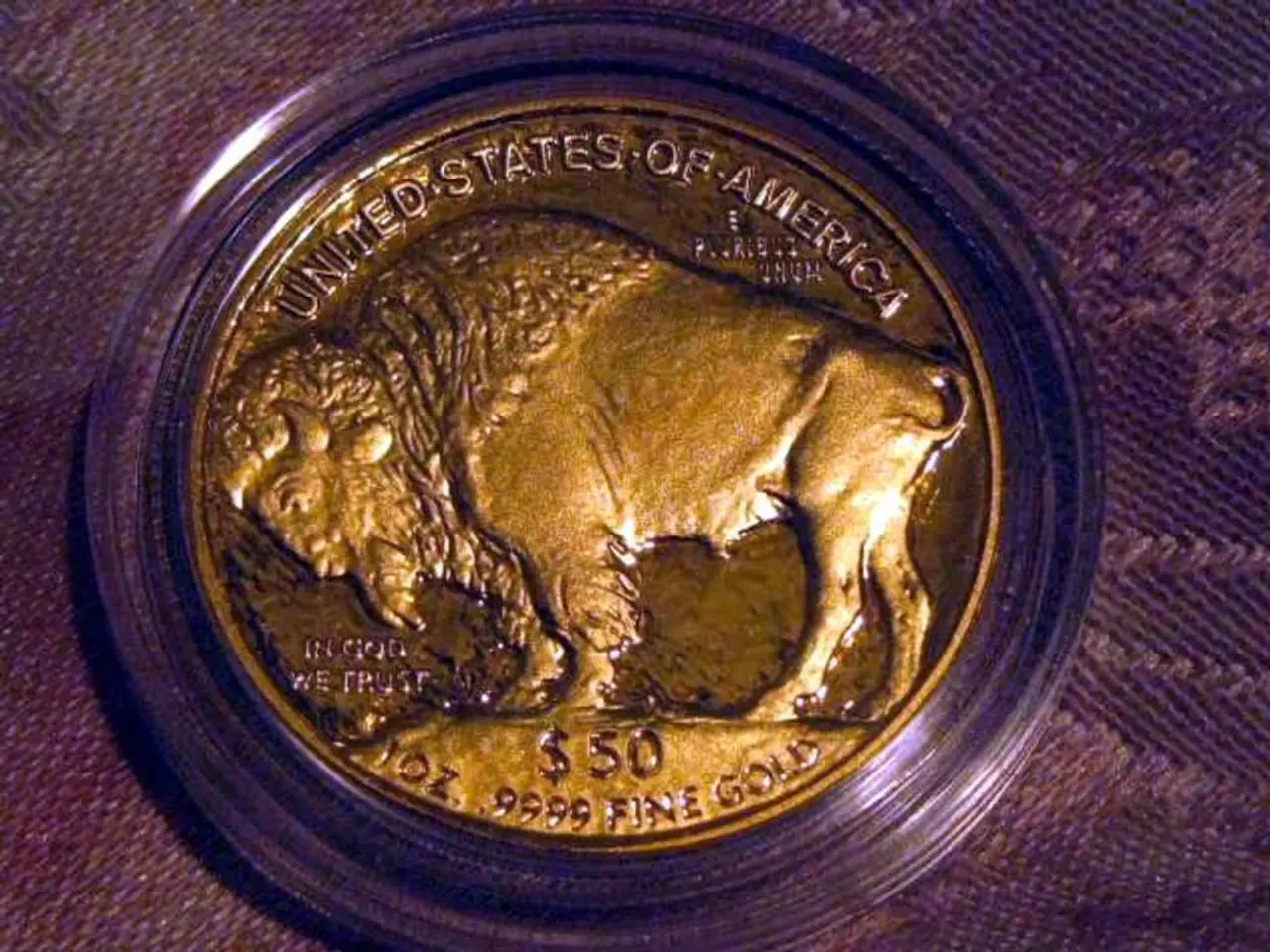

The main reason for the man's situation is that governments abandoned sound money and replaced gold coins with paper currencies. Central banks function as market manipulators and money printers for overspending governments, causing the price of consumer goods to rise and the numerical price of stock market shares to go up. This unsustainable world of consumer debts, mortgages, long-term loans, and the growing prospect of insolvency is a direct result.

The man's life is a testament to the argument that CBDCs facilitate a form of economic slavery by giving central authorities the power to micromanage citizens' financial lives, suppress dissent, and enforce conformity to globalist policies. The loss of financial privacy and autonomy is a key step in creating a controlled, servile population under a globalist economic regime.

In a twist of irony, the man is encouraged by the government to find personal meaning by joining the fight against global warming. Yet, when he is injured in a war, he returns home to find breadlines and food distribution centers for genetically engineered food. In his darkest hour, even his digital doctor offers him assistance in ending his life peacefully.

The man's story serves as a stark warning about the potential dangers of CBDCs and the erosion of economic freedom and individual rights under globalism. It highlights the need for a return to sound money and a rejection of the economic slavery that comes with centralised control over our financial lives.

Read also:

- Parliamentary Debates in the German Bundestag This Week

- Luxury Drinkware Gaining Popularity in UAE's Business Gift Exchanges

- Honoring Practical Learning: Commemorating National Apprenticeship Week in the United Kingdom

- Home-Based Business Opportunities for Mothers: Unleashing Earning Potential within Domestic Spaces